Private Debt Intelligence – 11/27/2017

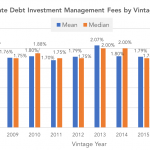

Private Debt Management Fees Both mean and median management fees for private debt funds have been moving down since the highs for vintage 2013 funds, with the average management fees falling to a 10-year low among 2017 vintage funds. The mean investment fee for 2017 vehicles has dropped to 1.52%, while the median fee has…