Preqin Private Debt Intelligence – 6/13/2016

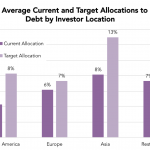

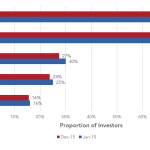

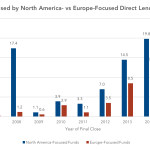

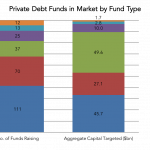

Investors Planning Larger Allocations to Private Debt Across all Regions Preqin research into the private debt industry finds that while investors in all regions are currently below their target allocation to the asset class, there is significant fluctuation between regions. Despite private debt in North America and Europe playing a crucial role in fundraising… Login