Preqin Private Debt Intelligence – 9/12/2016

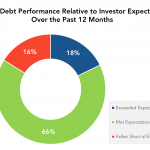

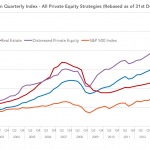

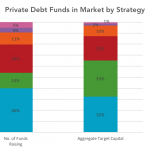

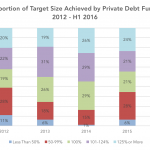

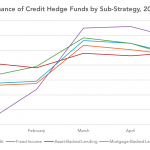

Private Debt Performance Spurs Potential Inflows The private debt industry has only become a mainstay of many investors’ portfolios relatively recently, but there is mounting evidence that the returns the asset class is providing for them are spurring investors to allocate ever-increasing levels of capital to the debt market…. Login to Read More...