Private Debt Intelligence – 9/18/2017

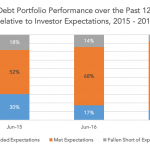

Investors Satisfied with Private Debt Performance Investors’ positive perception of the private debt industry remains strong moving into H2 2017, as cited by more than half (57%) of survey respondents. Potentially more telling, however, is the consistently low reports of any negative perception from investors…. Login to Read More...