Private Debt Intelligence – 11/14/2016

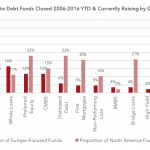

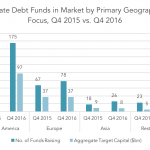

Europe- and North America-Focused Real Estate Debt Funds

Real estate debt has seen considerable growth within European markets over the past few years and fundraising grew significantly from €0.5bn in 2012 to €4.3bn in 2015, while a further €3.7bn has already been secured in 2016 YTD. Nonetheless, North America-focused fundraising still dwarfs that of Europe, with funds already raising a record €12.3bn in 2016...