PDI Picks – 4/10/2023

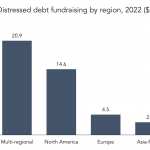

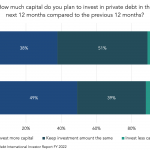

The return of distressed debt Special situations are emerging as a key fund focus in the 2023 mid-market, as managers respond to growing signs of distress driven by macroeconomic conditions. Interviewed for our PDI Mid-Market Lending Report 2023, Ed Testerman, a partner at New York-based fund manager King Street Capital Management, told us there are…