PDI Picks – 2/14/2022

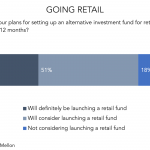

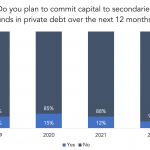

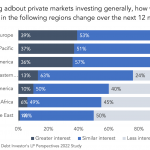

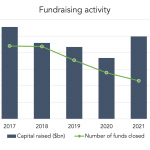

It’s not all about institutions All the talk is around retail investment as fund managers reach out to this potentially huge investor base. Retail investors have been beating at the door of the alternative investment industry and it appears the door is now being thrown open, as private debt managers increasingly fall over themselves to…