PDI Picks – 1/11/2021

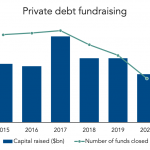

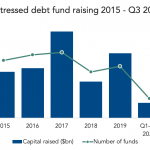

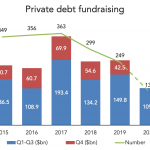

Fundraising takes a dip The pandemic has taken its toll on fundraising, but the largest managers appear to be benefitting. Unsurprisingly perhaps, private debt fundraising dropped to its lowest level in more than six years during 2020 as the effects of the coronavirus pandemic hit world markets. Preliminary data from PDI’s upcoming Fundraising Report 2020…