PDI Picks – 10/14/2019

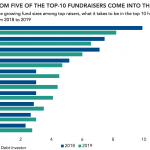

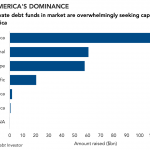

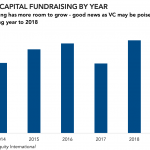

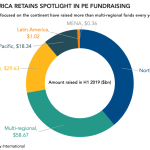

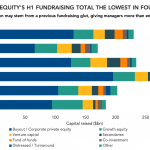

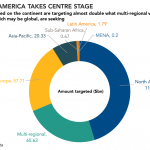

Another sign that the big are only getting bigger The baseline for being in the top-10 fundraises of the year increased from 2018 to 2019, signaling the growing dominance of a few firms. The overall capital collected by the top-10 fund closes this year has eclipsed the total raised by last year’s 10 largest fundraises,…