PDI Picks – 11/5/2018

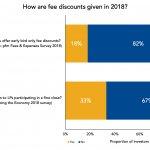

First-closing fee discounts can set GPs apart A surprising number of private markets managers don’t offer a break to their funds’ earliest investors. Private fund managers seem reticent to offer early-bird management fee discounts, according to two new surveys, closing a potential avenue to differentiate themselves as fundraising slows down. Private Debt Investor sister publication…