PDI Picks – 8/6/2018

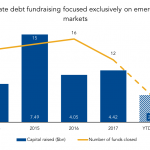

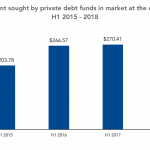

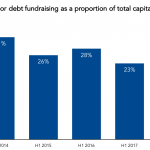

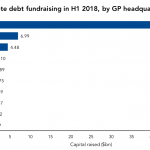

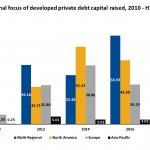

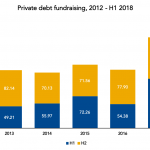

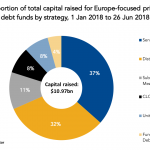

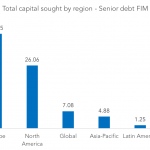

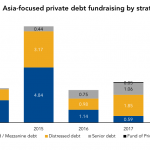

Emerging markets are on the rise for private debt Much of the activity has been in India, one market source told PDI, where distressed debt has been attractive as a result of new bankruptcy rules. Private debt targeting emerging markets has been trending upward in recent years, and 2018’s total may be poised to surpass…