PDI Picks – 1/21/2019

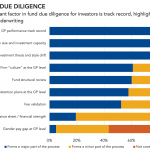

Underwriting’s influence on track record GPs’ documentation practices play an outsized role in private credit, and LPs should know whether they’re doing it well. Limited partners put an almost unanimous emphasis on a potential general partner’s track record, with 97.6 percent of respondents in our annual PDI Perspectives 2019 investor survey saying it forms a…