PDI Picks – 3/25/2019

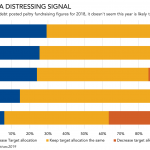

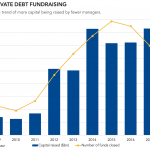

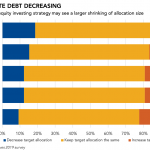

Distressed debt managers get a distressing signal Fundraising soared in 2017, but it came crashing back to earth last year, and it may not change this year. Despite all the talk of the credit cycle turning, distressed debt fundraising dollars and investors’ portfolio plans aren’t jiving with the hullabaloo…. Login to Read More...