Credit managers should embrace transparency

Fund transparency should become a key part of the asset class as it continues its maturation.

It’s no secret alternative assets are among the most expensive investment strategies. Of course, private credit, private equity and the like require a much more staffing-intensive effort than passive investment vehicles may need, and there’s the potential for outsized returns within private markets.

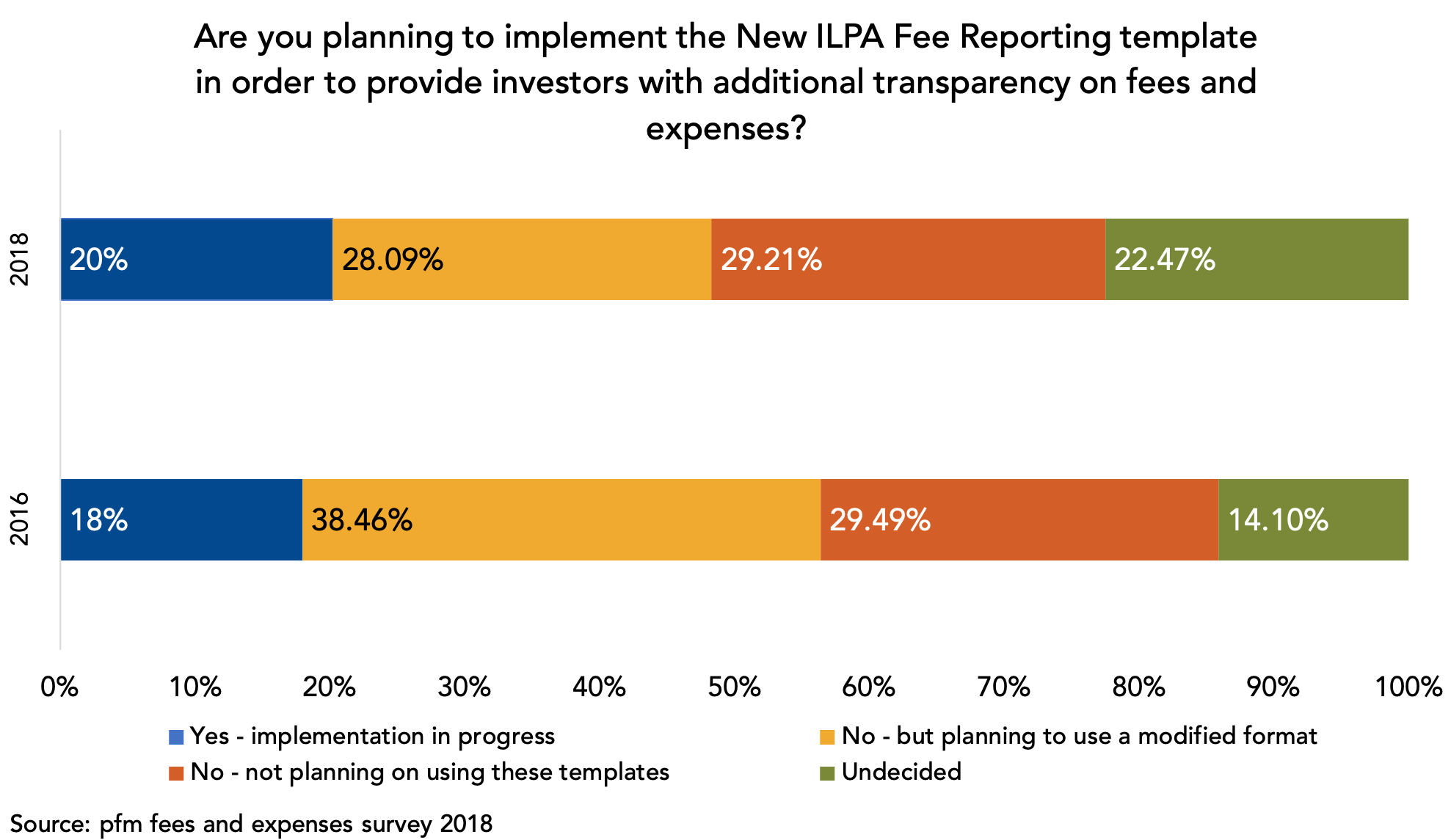

None of this, however, dents investor demand for transparency around fees and expenses, a cause that has been championed by the International Limited Partner Association for some time. This has resulted in a reporting template that has many supporters among LPs, including the California Public Employees’ Retirement Association and the Canada Pension Plan Investment Board.