PDI Picks – 7/8/2024

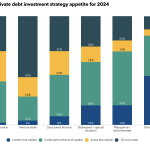

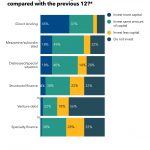

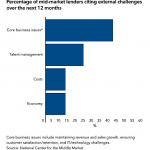

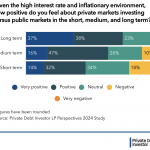

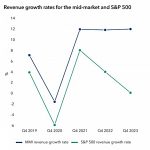

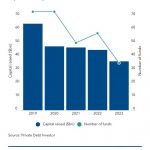

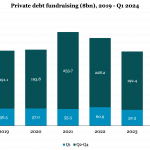

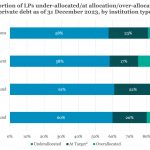

Direct lending still the preferred choice In a much-changed world, investors are inclined to support well-established strategies and geographies. As the saying goes: the more things change, the more they stay the same. While the volatile inflationary and interest rate environment has created very different conditions for private debt firms to navigate, provisional data from…