PDI Picks – 7/1/2024

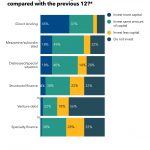

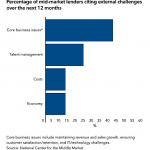

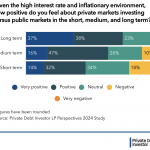

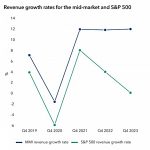

The rise of the periphery Specialty finance is grabbing the limelight by offering strong returns, downside protection and diversification. With many investors having reached a level of exposure to direct lending that they are comfortable with, it’s natural that they should then begin casting around for more esoteric opportunities. One area claiming attention is specialty…