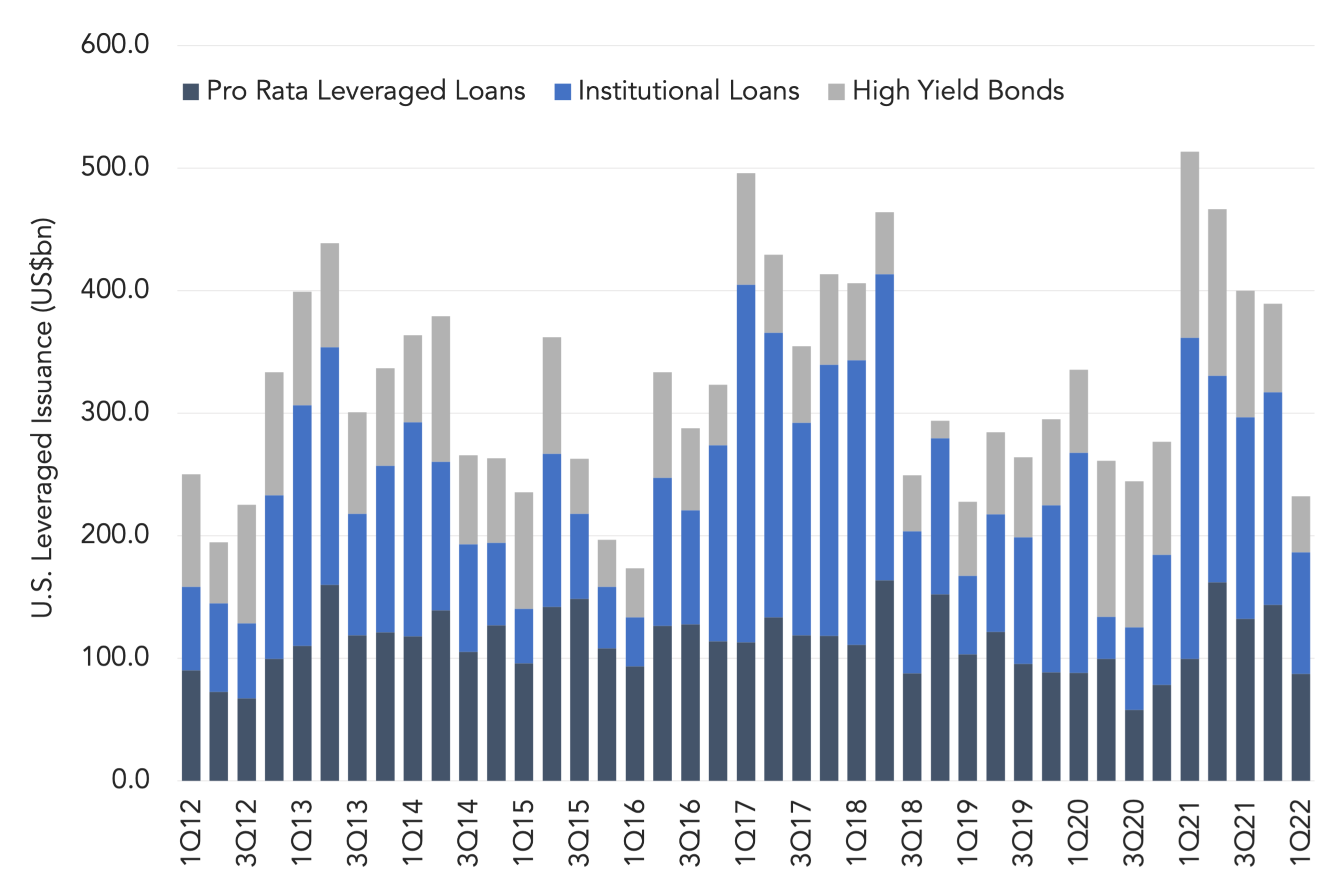

1Q22 Leveraged volume down 55%

amid inflation fears and Ukraine war

The combination of SOFR rollout, inflationary pressures, labor and supply chain issues and the war in Ukraine (as well as its impact on commodities) all tinged the US leveraged loan market in 1Q22, contributing to lower volumes and increasing spreads. At US$186.3bn, 1Q22 leveraged loan volume was down 48% compared to year ago levels.