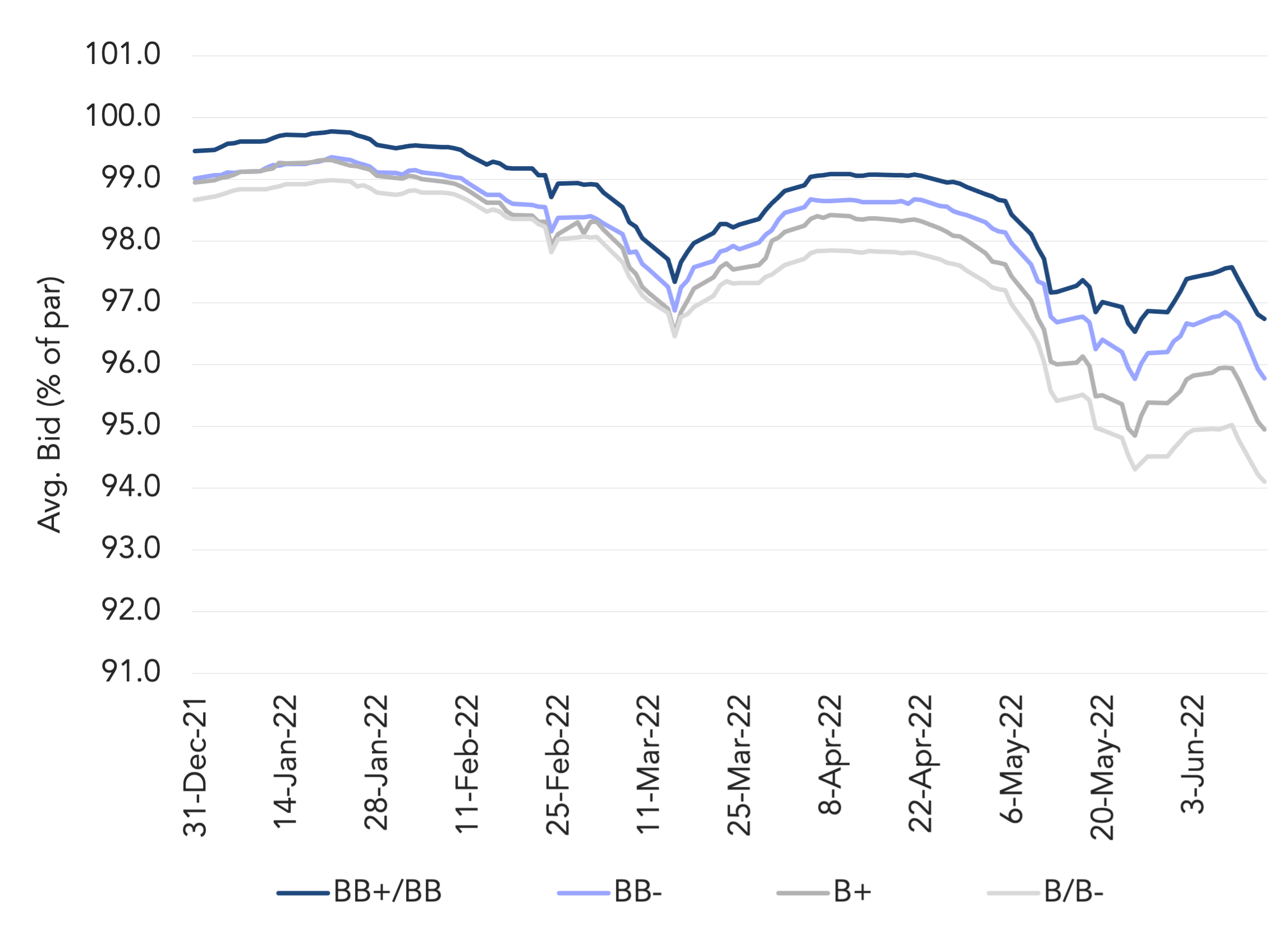

Lower rated credits post largest declines in secondary market

Risk assets have come under renewed pressure in recent days as rising inflation has prompted expectations of a more aggressive monetary tightening by the Federal Reserve.

Though equities and high yield bonds have been hit more severely, leveraged loans have not escaped market pressure with the overall secondary market average bid down by 82bp in the last week and 326bp year-to-date through June 14.