Interest grows in venture debt

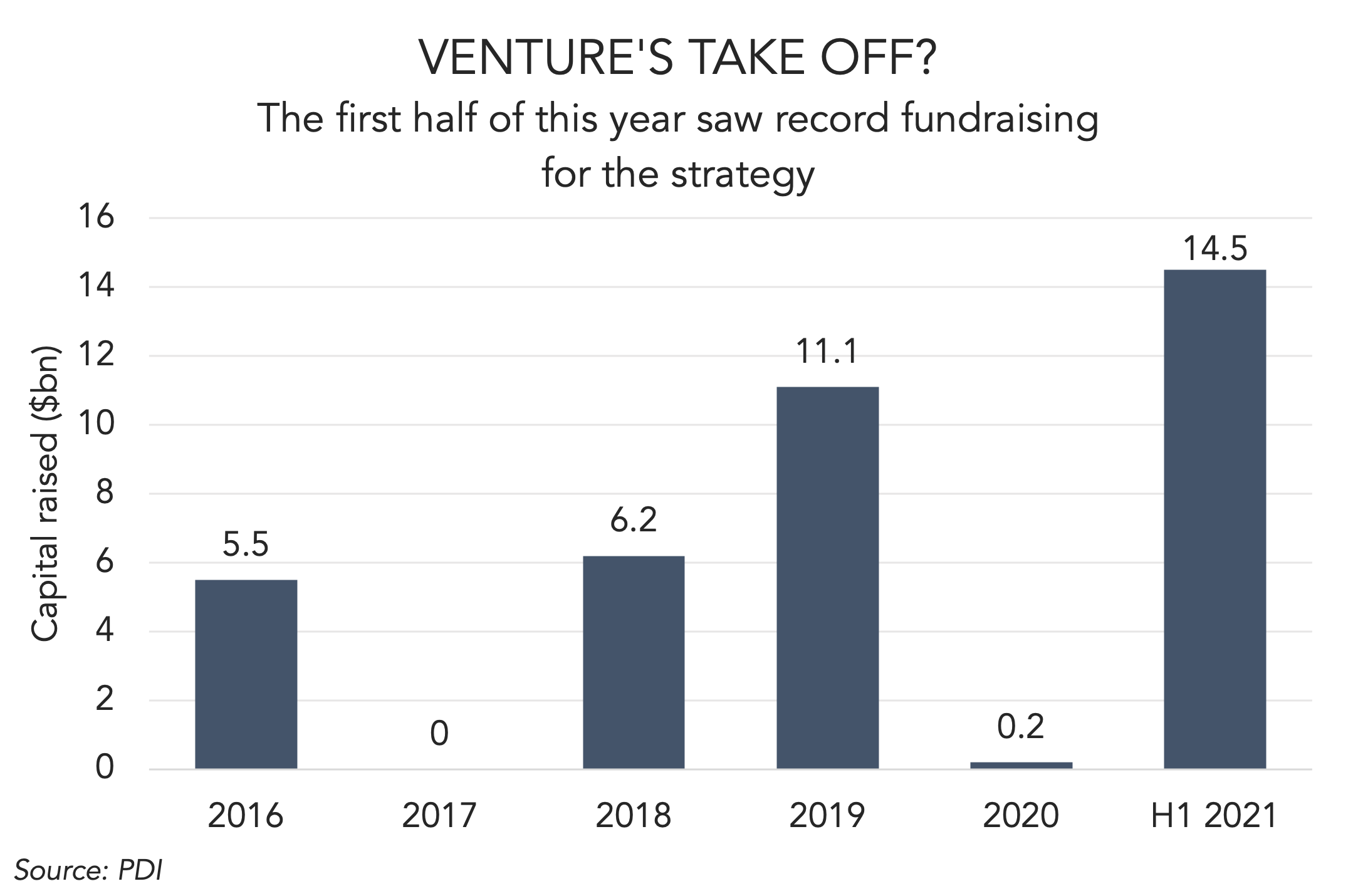

It’s still a relatively unknown corner of the private debt universe, but venture lending is attracting more support.

Venture debt is a small but growing part of the private debt landscape looking to fund small but very high-growth companies to help them reach their next stage in development.

In the equity world, the role of venture capital is well established, providing funding for companies ranging from start-ups through to those that are profitable and delivering risky but potentially lucrative returns to investors.

In debt, entrepreneurs are still getting to grips with the new array of financing options now being offered by alternative lenders. But recent research shows use of debt among early-stage firms is high.

Venture lender Runway Growth Capital surveyed entrepreneurs on their experiences as part of its Venture Debt Review 2020 and found that more than 80 percent have used the product to fund their business. Furthermore, a majority said they feel venture debt has become more attractive in the past 12 months.