Cash Flow Model: Kloeckner Pentaplast’s High Leverage

Under Base Case Mitigated by Sufficient Liquidity Under All Scenarios

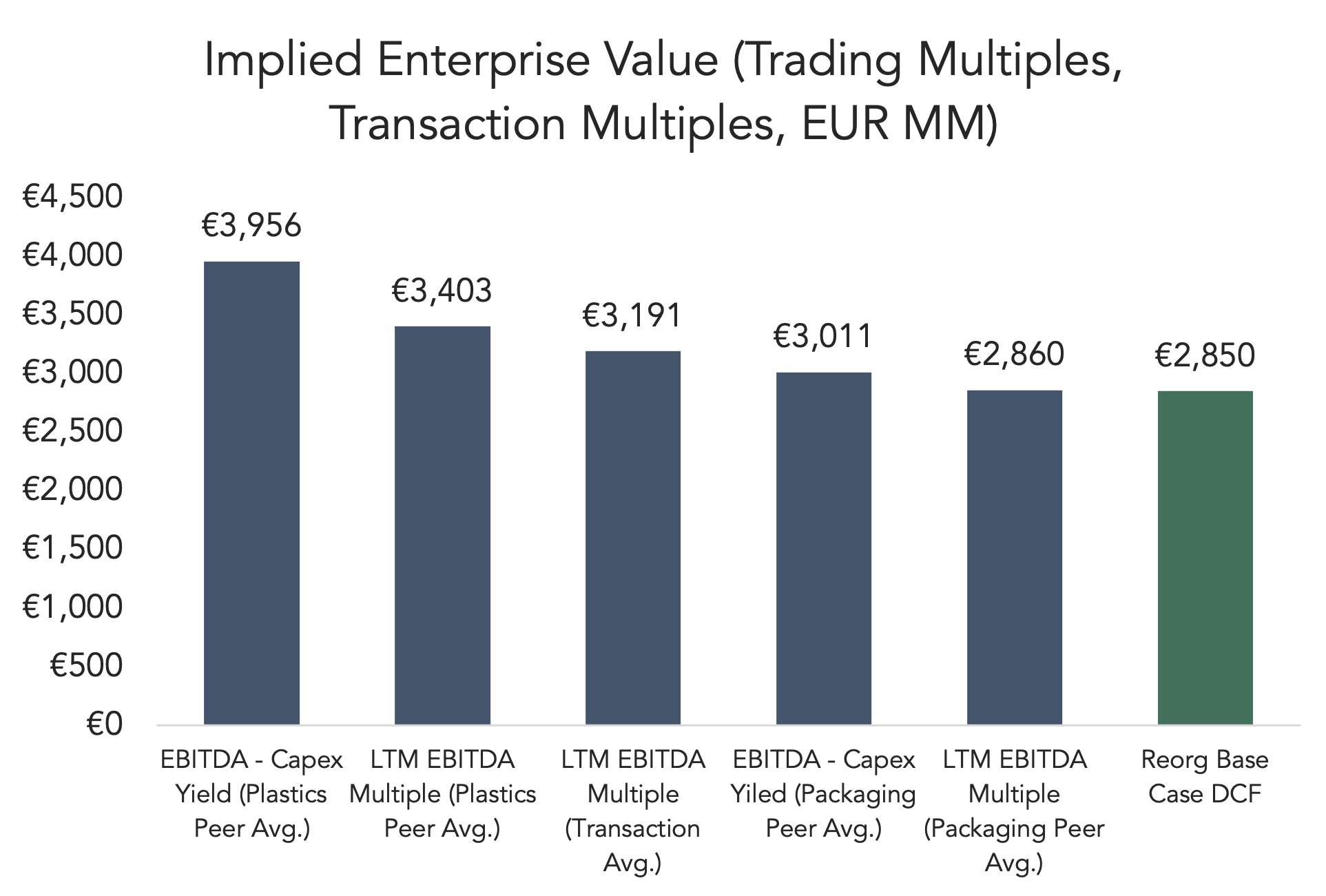

Kloeckner Pentaplast’s second-quarter results are expected to show significant improvements by management to pass through raw material costs during the German plastics packaging group’s previous two quarters.KP’s €300 million senior unsecured notes due 2026 have rallied on the back of management reiterating guidance for full-year EBITDA (on a constant currency basis) and free cash flow. The guidance has also quelled some concerns that KP is highly susceptible to margin contraction because of raw material cost increases, which were partly the reason behind the selloff of its €395 million Holdco PIK notes (refinanced in February) to the 40s in 2018. For our full analysis of the Kloeckner Pentaplast cash flow model click here.

Contact: Matt Danese

mdanese@reorg.com