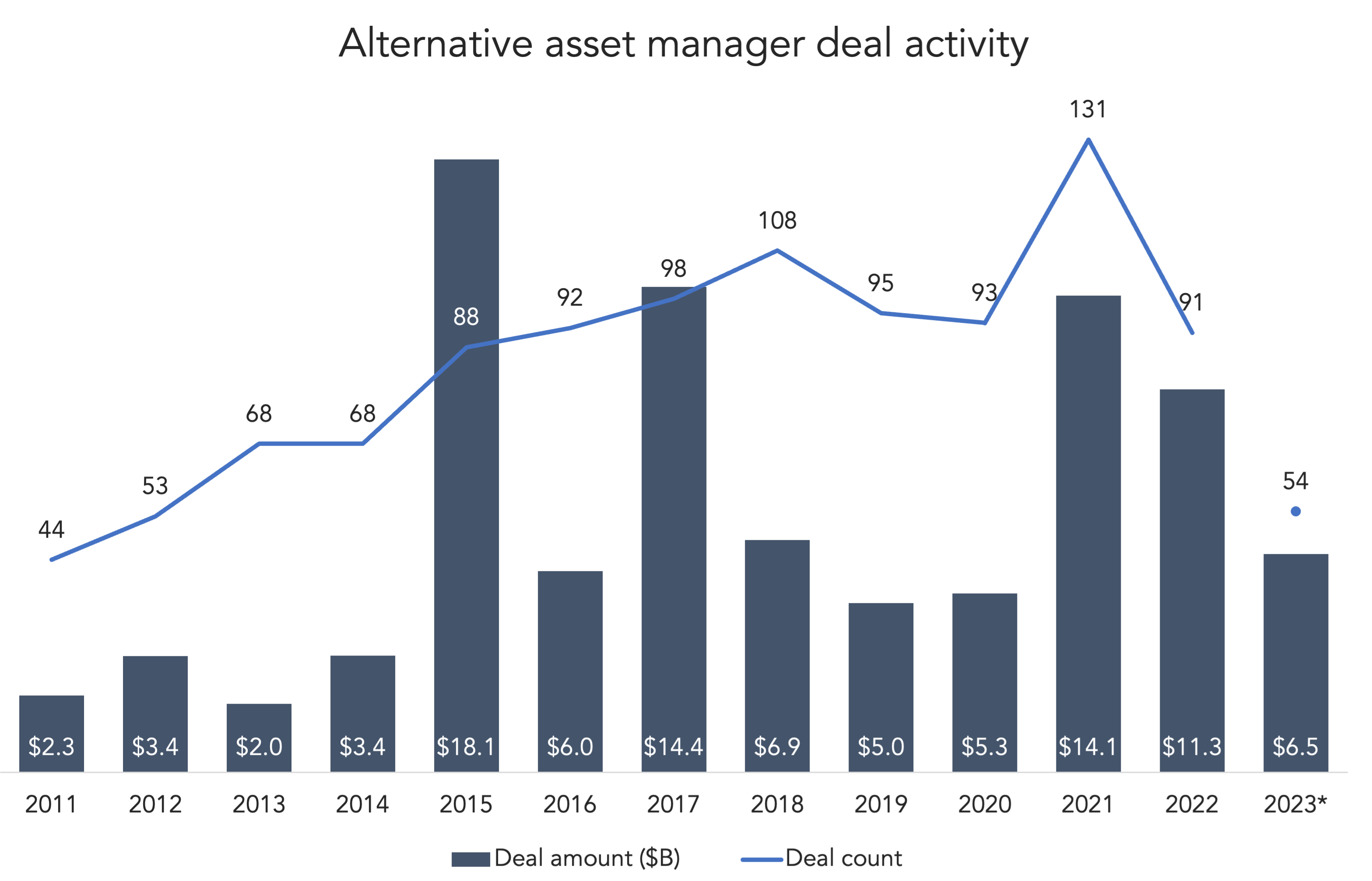

GP deal activity picking up

Chart

Download Data

Download Report

GP stakes and alternative asset M&A is picking up and features another slate of interesting deals. PitchBook’s latest US Public PE and GP Deal Roundup shows another healthy year for move-making among alternative asset managers. Control transactions are making up almost half of all transactions this year. The most notable is TPG’s $2.7 billion deal for Angelo Gordon, which managed about $73 billion at the time of the deal. That will bump TPG’s AUM over $200 billion when the deal closes in Q4. Among noncontrol transactions, Blue Owl bought a stake in Stonepeak, which specializes in infrastructure and manages almost $56 billion.