TheLeadLeft

The Value Props

We typically dedicate the new year’s first issue to reviewing the year gone by. Unfortunately when we emerged from the holidays, 2020 seemed lost in a fog of masks, sanitizers, and Netflix bingeing. Two items in December did manage to penetrate our consciousness. First was an opinion piece from our content partner, Creditflux. Fellow columnist…

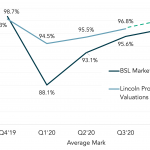

Chart of the Week: Steady As She Goes

Last year was Exhibit A on how non-traded loans perform amid volatility relative to their liquid cousins.

LevFin Insights: High-Yield Bond Statistics – 1/4/2021

Source: LevFin Insights Source: LevFin Insights Source: Lipper Contact: Robert Polenberg robert.polenberg@levfininsights.com

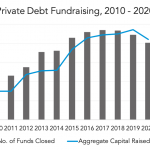

Private Debt Intelligence – 1/4/2021

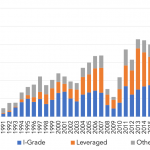

Private Debt Fundraising Slightly Slows in 2020 Since 2015, more than 200 private debt funds have been closing each year. Even with the slowdown that the COVID-19 pandemic caused in the alternatives assets industry, private debt fund managers were able to maintain this trend and closed 202 funds in 2020…. Login to Read More...

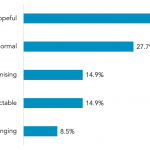

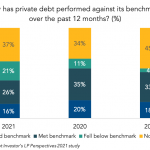

PDI Picks – 1/4/2021

The LP view of 2021 Our annual study of investor sentiment finds optimism over future performance and an enthusiasm for distressed debt. Amid all the worry and confusion that has accompanied the global health crisis, it can be difficult to focus on the fundamentals of business – understandably so. But investors in private debt know…

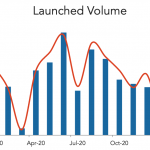

Leveraged Loan Insight & Analysis – 1/4/2021

2020 US Syndicated loan volume at 10 year low amid pandemic In a year overshadowed by a global pandemic, social unrest and a prolonged US election cycle, lenders pushed over US$1.5trn of loan volume through the syndicated market, a 27% drop over the same time last year and a 10-year low. Although Covid-19 was the…

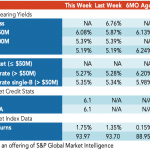

Loan Stats at a Glance – 1/4/2021

Contact: Marina Lukatskymarina.lukatsky@spglobal.com

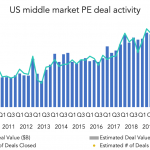

The Pulse of Private Equity – 12/14/2020

Middle market rebound in Q3 PE activity saw a healthy rebound in Q3, which was expected, according to PitchBook’s just-released Q3 Middle Market Report. An estimated $115.6 billion was invested last quarter, a 66% jump over Q2’s disastrous $69.6 billion tally. Volume also reversed course, with 711 transactions in Q3 and a 50% increase over…