The Pulse of Private Equity – 9/14/2020

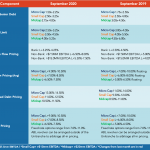

PE middle market update Download PitchBook’s Report here. PitchBook’s Q2 US PE Middle Market Report releases today – download your copy here – and the headline numbers largely mirror the broader PE market. Deal volume cratered in Q2, as expected, falling from an estimated 789 deals in Q1 to 504 in Q2, a 36% drop. Combined…