Leveraged Loan Insight & Analysis – 10/14/2019

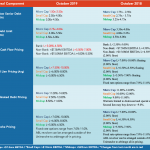

Recent investor challenged single-B deals have yet to gain traction since breaking in the US secondary market As bifurcation among credits continues, a number of recently launched deals for single-B names received significant investor pushback during syndication. Not surprisingly perhaps, none of these loans have been bid above their break price in the secondary market….