Leveraged Loan Insight & Analysis – 6/8/2020

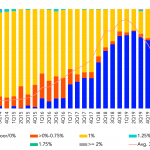

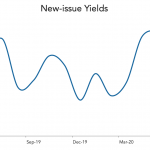

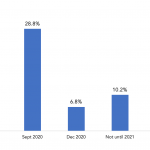

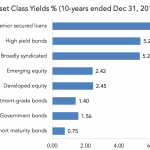

Libor floors are back in the institutional market Investors are demanding Libor floors on institutional term loans as the Libor rate continues to drop. While 3-month Libor has been in a declining trend since 1Q19, it has plunged since the COVID-19 crisis hit. The average 3-month Libor rate has dropped to 0.67% so far this…