Private Debt Intelligence – 4/2/2018

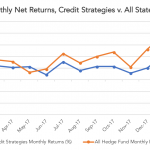

Credit Strategies Start 2018 with Positive Performance Preqin finds that credit strategy hedge funds have maintained their streak of positive performance, having generated positive returns on a yearly basis since 2009, and seeing returns of 7.41% in 2017. The strategy has started 2018 with a bang, producing positive performance in the first two months of…