Leveraged Loan Insight & Analysis -1/23/2017

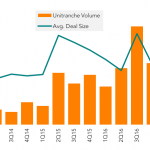

Unitranche volume grows while deal sizes get bigger

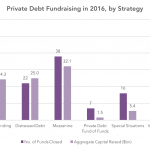

As money continues to pour into the middle market searching for yield, the unitranche structure continues to gain traction. Unitranche volume reached US$13.3bn in 2016, up from US$8.5bn in 2015. Bigger deals were seen in 2016 as more and more lenders continued to build scale and increase their hold size. The average deal size was $198M in 3Q16 and $129M in 4Q16. But 50% of unitranches continue to be in the $0-$100M deal size area...