The Pulse of Private Equity – 8/8/2016

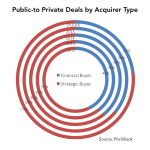

PE Buyers Are Still Not Taking Public Cos. Private Through the end of June, financial sponsors accounted for only 23% of all take-privates in North America and Europe. This isn’t necessarily a result of the overall incidence of take-privates… Login to Read More...