Leveraged Loan Insight & Analysis – 7/4/2016

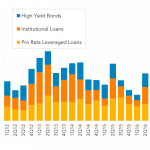

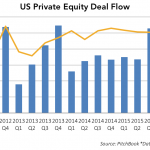

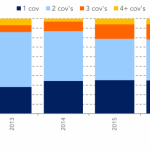

Improved market sentiment boost 2Q16 leveraged market; Opportunistic deals resurface The market volatility that emerged at the tail end of 2015 and seeped into 1Q16, eased in 2Q – at least until the Brexit vote – allowing lenders to step back to assess their pipelines against the back drop of a stronger high yield bond…