Markit Recap – 7/3/2017

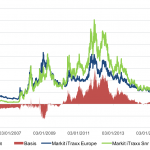

Senior Financials trading tighter than Corporates The fate of corporates and the banks that serve them is intertwined; that much is clear from the past decade. But though the correlation is close, it’s certainly not one-to-one. … Subscribe to Read MoreAlready a member? Log in here...