Leveraged Loan Insight & Analysis – 12/14/2015

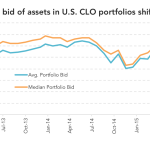

The secondary market continues to come under pressure, with increased differentiation between the so called haves and have-nots. Flow names fell by roughly 100 bps in November and are off another 55 bps so far this month. At a broader market level, multi-quote institutional term loans also fell by around 100 bps in… Login to