TheLeadLeft

Select Deals in the Market – 6/26/2017

☞ Click for a larger image.

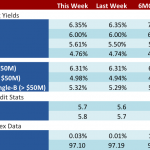

Loan Stats at a Glance – 6/26/2017

Contact: Timothy Stubbs timothy.stubbs@spglobal.com

Private Debt Intelligence – 6/26/2017

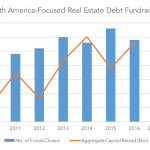

North America Real Estate Debt Closed-end private debt fund servicing the real estate market have grown in prominence in recent years, as investors seek to participate in a sector which offers an attractive risk/return profile, and strong overall performance. The bulk of this… Subscribe to Read MoreAlready a member? Log in here...

Markit Recap – 6/19/2017

Noble Group clings on A year ago this week, the credit markets were digesting the shock of a ‘leave’ vote in the Brexit referendum. What followed was a period of extreme volatility and it seemed that 2017 was set for more of the same…. Subscribe to Read MoreAlready a member? Log in here...

Leveraged Loan Insight & Analysis – 6/19/2017

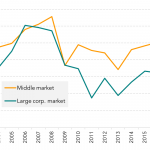

Middle market sponsor-backed issuers are seeing fewer repricings than large corp. issuers Private equity shops have taken advantage of strong liquidity in the loan market to refinance/reprice many of their portfolio companies into longer dated maturities, looser structures and cheaper pricing…. Subscribe to Read MoreAlready a member? Log in here...

Debtwire Middle-Market – 6/19/2017

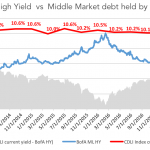

Source: Cliffwater Direct Lending Index and BofA Merrill Lynch US High Yield Effective Yield The red line in the chart is the *Cliffwater Direct Lending Index (CDLI) current yield, which is based on the investment income of the underlying assets held by public and private BDCs. BDCs invest in middle market companies, and the Index comprises…

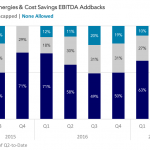

Covenant Trends – Cap for Synergies & Cost Savings EBITDA Addbacks

Contact: Steven Miller smiller@covenantreview

Select Deals in the Market – 6/19/2017

☞ Click for a larger image.