Dividends Without Tears

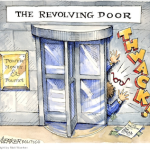

It’s that time of year again. We’re not referring to barbecues and Slip ‘N Slides, although both hot and liquid could be used to describe conditions in leveraged lending today. No, we mean it’s time to sit back and watch as dividend recaps come alive again. S&P Capital IQ’s Steve Miller had a great note…