Leveraged Loan Insight & Analysis – 6/15/2020

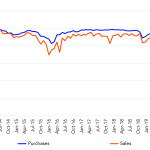

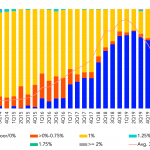

US CLO portfolios: average loan trades fell 7 to 13 points in March and April In the wake of the spread of COVID-19, as secondary loan prices plummeted, average US CLO portfolio trade prices fell between 7 and 13 points in March and April. By the end of April, sales prices were still declining, having…