The Pulse of Private Equity – 5/4/2020

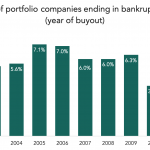

The bankruptcy question Download PitchBook’s Report here. A looming question over the next several months is how many PE-backed companies will be forced into bankruptcy. The odds suggest an increase in PE-backed bankruptcies as cash flows begin to dry up in the short term. According to PitchBook’s Quantitative Perspectives, GFC-era data offers some clues on what…