Markit Recap – 10/22/2018

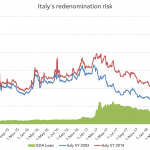

Mario Draghi, in a press conference confirming that market rate expectations were intact, stated that the risks to the eurozone’s economy are “broadly balanced”. His view may have merit, but there is little doubt that the situation is looking more precarious than a few weeks ago. If negative sentiment does permeate the market and spark…