PDI Picks – 4/20/2020

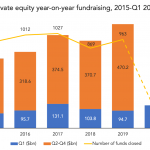

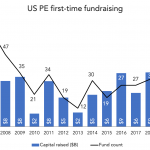

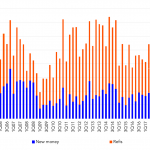

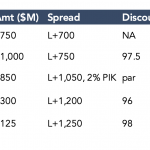

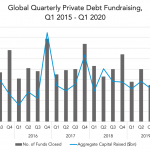

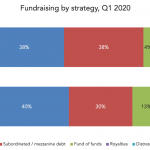

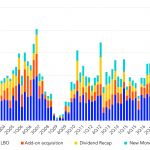

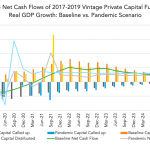

Private equity bandwagon rolls on, but for how much longer? Fundraising for the asset class was strong in the first three months of 2020 but continuing to defy the effects of covid-19 seems unlikely. As we have noted in this column over the last couple of weeks, private debt fundraising provides a neat reflection of…