The Pulse of Private Equity – 3/16/2020

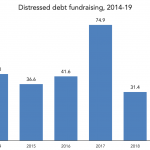

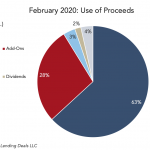

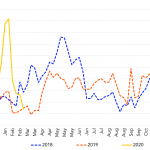

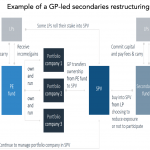

The private markets aren’t immune Download PitchBook’s Report here. Much was made of the “buoyant” nature of the SuperReturn conference earlier this month. The gathering took place just as stocks began stuttering and the opportunity for turnaround artists looked vibrant. Three weeks later, that consensus appears to be shifting as the underlying economy itself shifts…. Subscribe