The Pulse of Private Equity – 9/16/2019

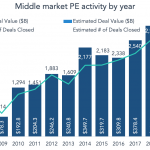

Middle market update Download PitchBook’s Report here. Middle market PE activity was strong through the first half of the year, according to PitchBook’s newly calculated Middle Market Report. Both deal value and overall volume are on pace to match or exceed last year’s numbers, both of which were records. The back half of the year has…