Private Debt Intelligence – 10/7/2019

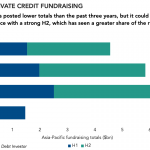

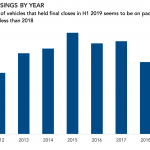

Private Debt Continued with a Slow Fundraising in Q3 Q3 showed no signs of recovery of, what has so far been, a slow fundraising year for private debt, closing just 24 funds for $22bn in capital, both quarterly lows for the year and the lowest amount of capital raised in any quarter since Q3 2016….