The Pulse of Private Equity – 6/4/2018

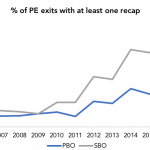

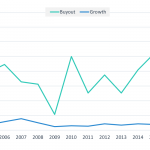

The upside of SBOs Secondary buyouts have been a contentious part of the PE industry for a long time. Limited partners are the most vocal about “pass-the-parcel” deals; in rare cases they are both buyer and seller of the same company (if they’re invested in both funds), but even when that’s not the case, studies…