The Pulse of Private Equity – 7/29/2019

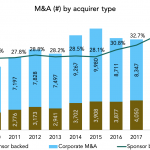

PE accounts for almost 40% of M&A Coming soon Download PitchBook’s Report here. PE-led acquisitions accounted for almost 40% of M&A volume in H1. That’s a remarkably high share for the asset class, which has historically led less than 30% of all acquisitions. The percentage has been creeping up over the past few years, according to…