Leveraged Loan Insight & Analysis – 6/24/2019

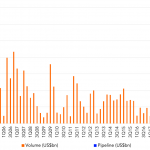

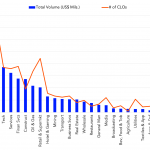

LatAm lending increases for third quarter in a row Latin America syndicated loan issuance was at US$12.2bn in 2Q19 as of June 19. While this is down 30% from 2Q18 numbers, it is up 72% from 1Q19 levels. An additional US$16.5bn were in the pipeline, suggesting an active 3Q19…. Subscribe to Read MoreAlready a member?