The Pulse of Private Equity – 4/1/2019

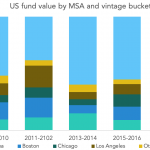

Private equity heads west New York is the epicenter of private equity, as it has been since its beginning. Wall Street was already around when PE got its start, and the important supporting actors—namely lenders and bankers—were all a taxi ride away.The same is true for Silicon Valley and the venture industry,… Subscribe to Read