Leveraged Loan Insight & Analysis – 2/18/2019

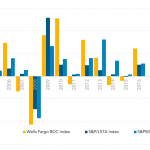

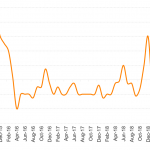

BDC returns superior so far in 2019 If you were not buying BDC stocks in the dip in December, you are probably feeling remorse because BDC returns are quite stunning so far in 2019. After posting a dismal -6.6% return in 2018 and 0.1% in 2017, returns have gone sky high so far in 2019…