Markit Recap – 10/30/2017

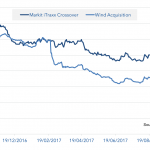

Venezuela – are we close to default? Waiting for a default on Venezuela’s bonds has been like waiting for Godot. Low oil prices and macroeconomic mismanagement has led to a catastrophic collapse in economic activity – our colleagues in country risk are forecasting a 7.5% GDP contraction. Civil unrest is on the rise,… Login to