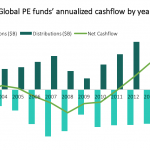

The Pulse of Private Equity – 10/2/2017

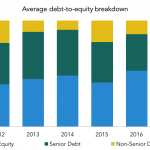

Less debt today, lower returns tomorrow? Download PitchBook’s 2017 Global PE Deal Multiples Report: III Here According to our just-released 3Q Deal Terms Survey results, average equity contributions have climbed to 57% of EV year-to-date. That’s the highest percentage in our dataset, which includes survey results dating back to 2012. Whenever we release these datapoints, we caution…