The Pulse of Private Equity – 2/4/2019

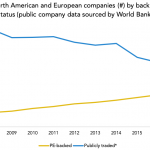

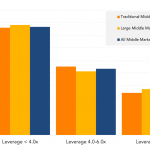

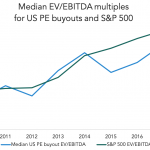

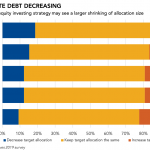

The institutionalization of M&A Download PitchBook’s Report here. Last week we highlighted the growing convergence of public and private multiples. For investors who dabble in both markets, there’s a baked-in assumption of a private market discount, since money tied up in buyout funds is illiquid, partially justified by cheaper entry prices and higher returns…. Subscribe to