Private Debt Intelligence – 12/3/2018

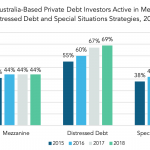

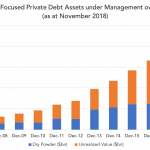

Australia-Based Private Debt Investors Look to Distressed Debt The pace of growth of the Australia’s private debt market has trailed behind other regions, most notably the US and Europe, but it is finally seeing an uptick. After a year-on-year decline in assets from 2013 to 2015, Australia-based assets has seen its private debt industry grow…