Leveraged Loan Insight & Analysis – 7/31/2017

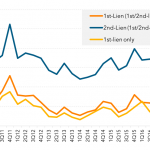

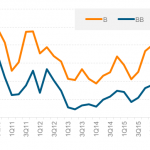

Yields of first/second-lien structures continue to tighten The average yield has widened to 5.46% so far in 3Q17 from 4.96% in 2Q17. One of the reasons behind widening yields is that while refinancings continue to lead activity, the share of M&A credits has increased to 40% of the institutional tranches priced so far this quarter….